Overview of the valuation methods

Pickware ERP provides you with three valuation methods for your inventory:

- First In First Out (FIFO)

- Last In First Out (LIFO)

- Weighted average

In the plugin configuration of Pickware ERP you can set the desired valuation method for your shop. By default, the valuation according to the LIFO principle is preset. Details on the individual methods and the basic calculation of the stock valuation can be found further down in this article.

View stock and generate report

Go to Items → Warehouse → Stock valuations to view, save and export your stock valuations as a CSV file. With Generate preview you can evaluate your stock at any time on the selected reporting date. You can tell whether the data displayed is a preview or a saved report by the heading.

To save the report permanently in your database, click Save report. Saved reports remain available even if the items they contain are subsequently deleted. We therefore recommend saving the preview as a report at the end of a reporting period, for example at the end of the financial year.

Calculation

The valuation can be done with LIFO, FIFO or with the weighted average of the period. All valuation methods have in common that at the end of a reporting period the existing stock including valuation is carried over to the next reporting period and entered as a goods receipt. Since all goods receipts require a purchase price, the plugin uses the average valuations of the previous period.

Basically, the valuation is made from the stock currently in the warehouse and all goods receipts of a valuation period. The carryover from the previous period (if available) also counts as a goods receipt. In the first valuation period, all goods receipts before the reporting date are taken into account accordingly.

Depending on the valuation method, the valuation results as follows:

LIFO:

The oldest goods receipts of a period are added up until the current stock level is reached.

FIFO:

The latest goods receipts are added up until the current stock level is reached.

Weighted average:

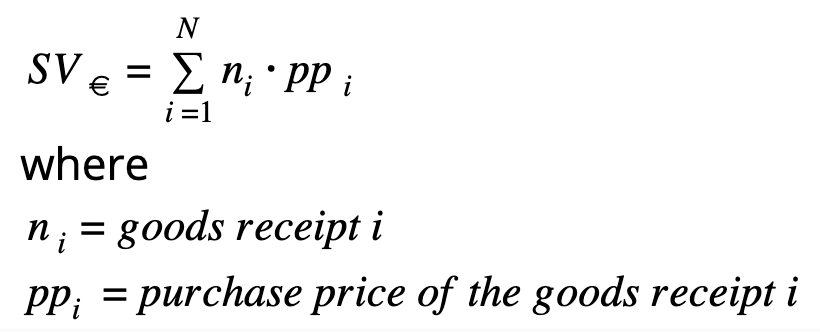

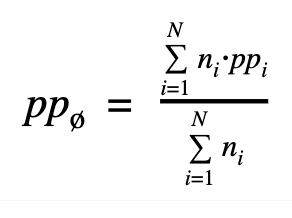

The current stock is multiplied by the average purchase price for the period. The average purchase price is calculated as follows:

Calculation example

For illustration, you can find a example here.

|

Booking date |

Booking type |

Quantity |

Purchase price |

|---|---|---|---|

|

04.07.2019 |

Initial stock |

100 |

5 € |

|

01.09.2019 |

Goods receipt |

50 |

4 € |

|

15.11.2019 |

Goods receipt |

70 |

6 € |

|

31.12.2019 |

Final balance 2019 |

80 |

|

|

01.01.2020 |

Carryover 2019 |

80 |

|

|

05.02.2020 |

Goods receipt |

20 |

7 € |

|

10.05.2020 |

Goods receipt |

30 |

6,5 € |

|

01.10.2020 |

Goods receipt |

100 |

3 € |

|

31.12.2020 |

Final balance 2020 |

110 |

|

|

01.01.2021 |

Carryover 2020 |

110 |

Depending on which method was chosen, the calculation results as follows:

|

LIFO |

|

|---|---|

|

Final balance 2019 |

80*5 € = 400 € |

|

Carryover 2019 |

80 pieces for 5 € each |

|

Final balance 2020 |

80*5 € + 20*7 € + 10*6,50 € = 605 € |

|

Carryover 2020 |

110 pieces for 5,50 € each |

|

FIFO |

|

|---|---|

|

Final balance 2019 |

70*6 € + 10*4 = 460 € |

|

Carryover 2019 |

80 pieces for 5,75 € each |

|

Final balance 2020 |

100*3 € + 10*6,50 € = 365 € |

|

Carryover 2020 |

110 pieces for 3,32 € each |

|

Weighted average |

|

|---|---|

|

Final balance 2019 |

(100*5 € + 50*4 € + 70*6 €) |

|

Carryover 2019 |

80 pieces for 5,09 € |

|

Final balance 2020 |

(80*5,09 € + 20*7 € + 30*6,50 € + 100*3 €) / 230*110 = 498,44 € |

|

Carryover 2020 |

110 pieces for 4,53 € each |